If the proposal to burn the Community Pool UST passes ( +1B UST) will 5 trillion more Luna Classic be minted?

Should not. The LUNA UST mint burn mechanism is currently disabled. Edit: The day to day increase decrease LUNA supply since about a week ago should be from wallets to and from exchanges and to and from on chain, people adding removing from LPs, buy sell pressure (eToro had just relisted luna example) etc. The mint/burn is off. All market speculation.

Do not mint any more LUNAs. The only reason to increase LUNA is only to compensate for UST loss, and that is only if UST customers would even accept that from the community separately from the aggrieved parties filing for restitution. Force majeure would not apply because the issue at hand is TFL failing to perform on redeeming debt. Can argue that stablecoins have inherent instabilities, but at this time it is a complete failure of their product. The compensation must be locked rather than using oracles based on the Robinhood algo to prevent a race to zero value on the LUNA side.

Has the snapshot already occurred? We are at block 7790840. If so, the proposal’s advertised time wasnt even close

This proposal has some strong points, but also some significant flaws. @ERG seems well-informed, thoughtful, and elegantly expressed; perhaps most importantly, they are collectively demonstrating the leadership and professionalism that is much needed here.

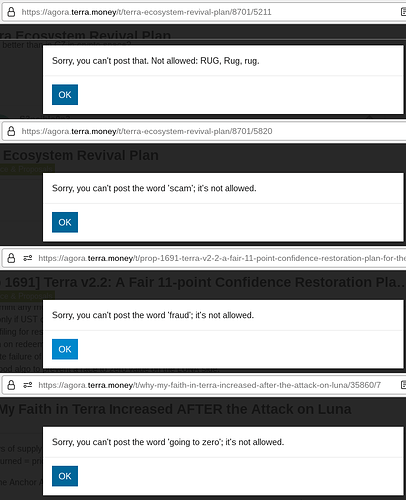

I don’t want to shoot down Prop. 1691. Rather, I want to see if and how it adapts to meet my hardest critiques. Given the scope of the problem, this will require multiple posts to cover; please have patience, as I am simultaneously trying to complete other last-minute things before the #rugfork (and the forum’s “slow mode” may restrict me, anyway?). Apologies if I sometimes ramble, as I must get this out ASAP.

I will start with one potentially fatal problem which also afflicts the #rugfork. It’s not fixable there; it may be fixable here. In recognition of @ERG’s honest listing of the fork under “Highest Priority Threats”, I will put the following primarily in terms of a critique of Prop. 1623.

I believe that the Prop. 1623 #Rugfork will cause irreparable harm—definitely and immediately, to UST holders and to LUNA holders; potentially later, to cryptocurrency as a whole.

Now, at the eleventh hour before the scheduled network fork, the only way to limit the damage is to inform the public that the so-called “LUNAv2” is a radioactive asset: It will eventually burn anyone and everyone who touches it. Most of all, centralized exchanges must avoid the trap of listing it. That way lies a future regulatory nightmare.

Thoughtfully though it is written, OP here makes a fatal error, which illustrates why:

For #11, airdrops trigger taxable events in the US. Let us not consider this option until we separately discuss a better plan. It does not make sense to punish everyone for holding massively fallen LUNAv1 and USTv1 coins and then be punished again with taxes for the new airdropped USTv2 tokens after a massive loss. This is an anti-shareholder option and has not been well thought through.

For my part, I absolutely disclaim being a “shareholder”. I did not buy unregistered securities. I do not hereby own shares in any enterprise, and I did not make any capital contributions to any enterprise.

Rather, I purchased at market a fungible virtual currency token: LUNA. LUNA was advertised as the principal reserve currency of an “algorithmic central bank” issuing UST notes and similar obligations, not as equity in a company. I demand that my fungible virtual currency token must stay what it is: A cryptocurrency, not a quasi-stock.

For the record: I am not only saying that now. I don’t buy stocks—not at all; I just don’t do stocks! I buy many cryptocurrencies. I properly treat this as trading forex, not stocks. If LUNA had been advertised as a stock or quasi-stock, then I would have been totally uninterested in purchasing it.

The impending Prop. 1623 Rugfork will effectuate a theft by conversion of value both from UST holders, and from a subset of LUNA holders wrongfully disfavored by Terraform Labs. The so-called “LUNAv2” token thus created is an instrument of financial F·R·A·U·D, designed to extract and divert capital as desired by Do Kwon and Terraform Labs. Moreover, it destroys the fungibility of the LUNA token: Different units of LUNA are treated as having different values.

The Prop. 1623 Rugfork turns LUNA from a fungible virtual currency, which is perfectly legal, into an unregistered security with retroactively imposed shareholder classes based on some notion of paid-in equity. It could not have been better calculated to assure even greater catastrophes than Terra has already made.

As soon as securities regulators figure out what Do Kwon and Terraform Labs are doing with this rugfork, everyone who touches so-called “LUNAv2” will be in a world of hurt. So may cryptocurrency as a whole, if Terra triggers a wider securities regulatory crackdown that unjustifiably affects crypto-currencies.

The purported “LUNAv2” is an illegal security. Not a cryptocurrency.

Don’t list it. Don’t buy it. Don’t hold it. Don’t stick your head in a noose.

I have been actively striving to warn people about this since May 17. I have been impeded by Twitter’s censorship of me as a Tor user (see also (archive)).

I did not want to raise such an important, explosive issue first on this forum. This forum is a centralized platform controlled by Terraform Labs. The moderators have been acting irrationally—even outright childishly. To understate the matter: They have been violating what I believe is their fiduciary duty to facilitate discussions without a bias favoring TFL and its proposals. And they are knowingly covering up for something bad. The Terra forum moderators are wearing their own mentes reae on their collective sleeve.

Raising such a major issue for the first time on this forum seemed it may be counterproductive. I first mentioned the unregistered-securities problem here on May 23 (archive).

@ERG, much of your analysis is spot-on. At the eleventh hour now before the fork, please stop thinking of “shareholders” yourself, and let us know how you think the SEC will react when it realizes that TFL is, indeed, retroactively creating classes of shareholders in an illegal stock.

Others are beginning to notice what has been obvious to me for over a week. E.g., this Bloomberg opinion author evasively tries to equivocate; but I think the writing is on the wall.

Much though I personally disagree with securities regulation, I am thinking in terms of precedents here. Cryptocurrency—currency, money, independent and unregulated—has the public precedent of an established history in real-world practice since 2009 in Bitcoin. Independent stablecoins that defend their pegs have an established precedent in Tether since (IIRC) 2014. Terra’s collapse may destroy that precedent; I seek to preserve and defend it.

For better or for worse—for worse, in my opinion—defi has already long established a precedent that it must avoid violating securities regulations. There is no precedent for issuing crypto-stock to “shareholders” without getting in trouble!

I must choose my battles. I am not here to fight against the precedent against unregistered securities: I am here to stop Do Kwon/TFL from running Terra so badly afoul of it, they invite a general crackdown that may afflict all cryptocurrency.

For I think long-term, and in historical terms. On May 11, in a follow-up to my very first post on this forum, I wrote:

I mean what I say. At this juncture, having apperceived an existential threat to all cryptocurrency, the value of my own multimillion-LUNA holding is of relatively lower priority. I am fighting primarily to protect the principle of free money: The right to create new currencies without government blessing—in a word, the right of Bitcoin to be Bitcoin.

LUNA is currently a meme coin. Somewhere in his writings (sorry—hurried here), I think that I saw @ERG correctly identify UST as, in effect, the fundamental cause of LUNA’s value. I have been saying that consistently, ever since I appeared here. Terra is a one-trick pony. It is a Cosmos SDK network with no significant differentiating features, other than the algorithmic peg system.

Terra ecosystem developers who have been on the Terra gravy train are suffering the conceits and myopia of an inability to see beyond their own little world. As a developer myself, I have no interest in the Terra ecosystem without the peg. No matter what wild P&D corrupt whales and Twitter “influencers” may pull off in the short-term, I believe that the market will agree with me in the long term: With the peg abandoned, as I have said many times, the proper price of LUNA is zero.

I will support good plans to make UST holders whole, restore confidence, and rebuild a post-Terra LUNA ecosystem with restored fundamental value.

If no such plans succeed, or are feasible—if the irreparable harm of the #Rugfork is too grave for any hope of recovery—then I will treat LUNA as a meme coin, toy money for fun and games. In that case, I will still cherish my dear little LUNAs, wipe the tears from their millions of silvery lunar eyes, and comfort them in the sorrows of their doom. Nonetheless, I will admit frankly that their only substantive value is sentimental, and perhaps as a collector’s item. Perhaps from there, something greater could be built—but if so, it would be approximately starting from zero, building from the ground up.

There is no other way.

My thanks to @ERG for the organized effort to stand up for the keeping of promises, to call out parties who have violated their fiduciary responsibilities, and to salvage from this wreck some semblance of honest money.

Thanks for your thoughts regarding LUNA LUNA V2 and securities. I concur and decided already not to touch Terra V2 tokens or chain until legalities cleared (so maybe never). Agree too with original Terra’s original mission, and getting the chain functioning towards decentralized currency, market and fates of UST LUNA paramount unless, as you say, meme coin status is here to stay. Prefer the decentralized economy route.

There is no flaw in our definition. Let us review the fundamentals of this Terra economy:

-

The UST is the money.

-

The LUNA is the property.

-

You can buy properties with money.

-

You can rent (staking) your property for money.

-

You can borrow against your property as collateral.

-

You can pay interests on loans with money.

-

You can sell your property for money.

Notes:

-

Without money your interest paid doesn’t mean anything.

-

Without money the value of your property doesn’t mean anything.

-

Terra v1 needs money to function.

LUNA is a crypto asset. It is not a crypto currency. Its value is derived from money.

When you bought LUNA you bought into a speculative investment that gains value from future interests received from the total locked value of borrows. UST represents money, but here it is actually debt. You exchange debt knowing that TerraForm Labs will cover the UST’s stability. Those who bought UST are customers who need to use UST to pay for groceries and utilities. These customers bought the UST instrument for convenience and they do not care about LUNA’s value. Thus, LUNA are investors and UST are customers.

What happens when a company is unable to redeem the UST when customers demand it? The company is in technical default of paying back money owed, and this is quite illegal to not have at least the difference or overcollateralization, because again, UST customers are not supposed to be crypto investors. They were supposed to be UST users such as on the CHAI network reaching millions of South Korean stores using the Terra currency (TerraKRW) for non-crypto business.

Buying LUNA cannot be called buying crypto currencies. They are future assets used to stabilize depegging. The $10 billion BTCs were supposed to buy up depeg shocks to recover some level of value, but when the amount of reserves simply cannot support the total money printed, then fear grows exponentially, and grows maximum when BTC value falls in tandem as there are now even less defensive power.