Proposal to Increase the Burn Tax to 0.8%

Summary:

This proposal aims to increase the current burn tax from 0.2% to 0.8%.

The purpose is to address the problem of not burning enough supply with the current tax in place, help to mitigate the over-minting problem, and respond to community demands for a larger tax, the overall feeling and all-time high were better when the 1.2% burn tax was in place, plus the community was united with one goal in mind.

Motivation:

There are several reasons why the burn tax needs to be increased. First, the current tax is not sufficient to burn significant enough coins. Second, there is significant community demand for a higher tax. Third, previous efforts to decrease the tax have not yielded the intended results. For instance, decreasing the tax to increase on-chain traffic failed to achieve the desired outcome. Similarly, the fear that the tax would harm centralized exchanges (CEXs) has not been borne out, as CEXs have adapted well to the tax, with only minor issues. Additionally, some members of the community have suggested that the high tax is a problem for Dapps to operate on the chain, but evidence suggests that most Dapps are able to function with a tax rate in place(after the guidelines made by Raider from TR), plus this proposal builds on recent suggestions, such as the proposal by Dfunk to exclude smart contract transactions from the scope of the burn tax ( [Proposal] Exclude Smart Contraction Transactions from the scope of Burn Tax ). However, increasing the tax will help to burn more supply and incentivize more CEXs to ask to be whitelisted like Binance, as proposed by Ed (Signaling Proposals around 3 Optional Features in the next release - #21 by TheWildLion ).

Proposal:

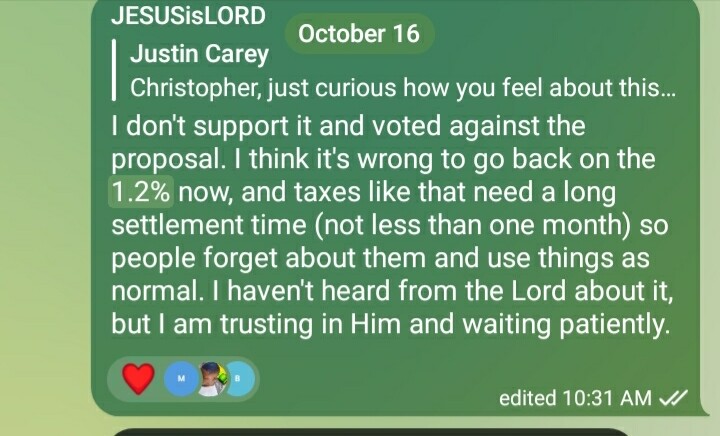

I propose to increase the burn tax from the current 0.2% to 0.8%. This change will stay in place for at least three months (suggestion) to avoid a yo-yo effect. If catastrophic reactions occur, the proposal can be revisited, but previous experience suggests that the benefits of a higher tax outweigh the problems. The proposed increase will help to mitigate the over-minting problem and satisfy community demands for a larger tax.

Conclusion:

In conclusion, this proposal seeks to increase the burning tax from 0.2% to 0.8% to burn more supply, soften the over-minting problem, and respond to community demands for a higher tax. It takes into account previous efforts to decrease the tax and recent proposals to address concerns about the tax’s impact on Dapps and CEXs. The proposed change will stay in place for at least three months and will be revisited if necessary. Overall, this proposal offers a simple and effective solution to address a critical issue facing the chain which is the total supply. I understand that is not the only solution but in conjunction with others can help bring more interest and investors to the chain.

At the end of the day, it is up to the community to decide whether or not to raise the burn tax, as the community is the driving force behind Luna Classic.

Proposal:

{

“subspace”: “treasury”,

“key”: “TaxPolicy”,

“value”: “{“rate_min”: “0.008”, “rate_max”: “0.008”, “cap”:{“denom”: “usdr”, “amount”: “60000000000000000” }, “change_rate_max”: “0.0”}”

}