I have now completed the proposal according to my satisfaction and I feel it is at a position that it can be put for a vote.

I have addressed all concerns and feedback that came to me over the course of the last few days after publishing the proposal, and I have ensured that I make this a proposal not just for $USTC holders, but for the entire Terra Luna Classic ecosystem in which $LUNC holders would benefit the most.

I have added the following sections to the proposal after my first post on this thread (the changes have also been made in the Dropbox Paper document):

- Stability & Precautions (which deals with how the peg is maintained)

- Community DEX (a complete system that re-enables swaps and arbitrage trading)

- Wrapped Stable Tokens (WSTs)

- Liquidity Pools

- Frequently Asked Questions (FAQs)

NOTE:

This document is best viewed on a desktop with a minimum resolution of 1920x1080px. However, a PDF version is provided as well for offline view.

(RECOMMENDED) Online Version URL:

https://www.dropbox.com/scl/fi/cklwxyamvcaqph3dq63q7/USTC-INRT-USDTR-Repeg-LUNC-Revival-Plan_Proposal.paper?dl=0&rlkey=80x0ib5r2x1tbmfciq7s7i0qd

Offline PDF (ATTACHED and also) available at:

This document is divided into smaller components or sections that can be browsed using the bookmarks on the left (if viewing on desktop in the Dropbox Paper application).

It is a request to take the time to go through each section in detail. I have included a TL;DR of the document in a section but it is much better if all voters went through the complete plan/proposal.

P.S. This thread continues from the following thread on the same subject:

I just tried to post this as a comment on the original thread but Agora is not allowing me to post such a large body of text there so I am posting this as a separate thread. I will attach links to both threads while putting this for a vote.

Since this proposal is too large for Agora, I will post the FAQs & Notes separately after some time in the comments.

$USTC↔️$INRT↔️$USDTR Repeg & $LUNC Revival Plan/Proposal

Introduction

1 $USTC is currently 98% below the peg of $ 1 USD, but 1 $USTC is 64% above the traded value of 1 INR (Indian Rupee, represented using the symbol ₹).

INR is the official currency of my country and it is 82 times lesser than a dollar.

In other words,

$1 USD = approx. ₹ 82 INR

So,

1 $USTC = $ 0.02 = ~ ₹ 1.64 INR

It may not be possible to repeg $USTC (without a complete buyback or reverse split of the blockchain) since it is 98% below value, but it is definitely possible to issue a stablecoin that can only be bought using $USTC and/or other de-pegged stablecoins.

- In this plan, neither is a reverse split required, nor is building any complicated modules required

In fact, a stablecoin can be issued on the Terra Luna Classic blockchain pegged to the Indian Rupee INR backed 100% by reserves.

The following block diagram describes the complete ecosystem which will have to be designed and developed in order to repeg $USTC.

Fig 1: Complete $USTC↔️$INRT↔️$USDTR Repeg System

Although the block diagram above is represented as a singular unit, it is in fact divided into 5-6 modules, 3 different processes and 2 interconnected group of specifications.

I will attempt to describe the complete process in layman terms so that the process and the work required to be done is understood by technical as well as non-technical members of the community. I will limit myself to using technical terms as much as possible in this document.

What is $INRT

$INR-Terra or $INR-T, abbreviated as, $INRT is a native stablecoin of the Terra Luna Classic ecosystem pegged to 1 Indian Rupee (₹).

- $INRT is the first truly decentralized trustless stable cryptocurrency coin in the world

$INRT will be issued on the Terra Luna Classic blockchain, developed and maintained wholly by the Terra Luna Classic community.

$INRT shall NOT be legally undertaken by TFL, Do Kwon and/or any other entity, team or individual currently represented in the Terra Luna Classic ecosystem.

$INRT shall be developed and maintained ONLY by the developers of the Terra Luna Classic ecosystem.

$INRT shall be governed by the Governance process (gov module) of the Cosmos ecosystem and a separate governance portal and discussion forum will be made available to the community members to govern all affairs related to $INRT.

Tokenomics

- $INRT shall be issued on a strictly on-demand basis and there shall be NO airdrops issued to participating wallets

- $INRT shall NOT be airdropped to “pre-crash” wallets indicated in the snapshot before the crash of Terra-Luna

- There will be absolutely NO KYC permitted while issuing $INRT by any entity which requests for $INRT to be issued

In order for us to be able to issue $INRT on the Terra Luna Classic ecosystem as a native token that has a value, we require a $USTC pool that shall be converted to an initial $INRT pool.

Total Value of $USTC Pool required (as initial investment) - 3,000,000 $USTC

Value of 1 $USTC - $ 0.02 USD

Value of $ 1 USD (in Indian Rupees) - ₹ 82

Thus,

Value of 1 $USTC (in Indian Rupees) = 0.02 x 82 = ₹ 1.64

Total Value of $USTC Pool (in Indian Rupees) = 3,000,000 x 1.64 = ₹ 4,920,000

Since, 1 ₹ = 1 $INRT,

Total Initial Supply of Tokens - 4,920,000

Value of 1 $INRT (in $ USD) = 1 ÷ 82 = $ 0.012195 USD

NOTE:-

- The above is a representative figure for the number of tokens issued initially since the total number of tokens will depend upon the total investment available for the investment during the launch of the token sale

- The actual number of tokens issued will be slightly lesser than the calculated number since there will be some consumption of gas fees in the process of moving the $USTC and issuing the tokens for the initial token sale

- A separate whitepaper shall be released in the coming weeks in which the complete $INRT ecosystem plan and possible applications of $INRT will be described in details

$USTC is being used as an example in the following sections to describe how the system would function with $USTC as well as the other 22 de-pegged currencies.

Conditions/Constraints/Specifications

The specifications below have been divided into two separate sets to understand how they correlate with each other and how the process flow of the system works.

Although it is in no particular order (since this is a decentralized system and all processes work parallel to each other), the following specifications describe the general conditions under which the system shall operate.

Specification Set 1

- $INRT can only be bought in lieu of $USTC and/or other stablecoins issued on the Terra Luna Classic ecosystem

- $USTC and/or stablecoins issued on the Terra Luna Classic ecosystem create the reserve pool required for $INRT, when $USTC and/or other stablecoins are traded/swapped for $INRT

- Since $INRT is a stablecoin, the reserve pool has to be maintained 1:1 with another asset class that will balance the number of $INRT tokens being issued in exchange for $USTC and/or other stablecoins

- Instead of maintaining this reserve pool as fiat (in a bank), we will maintain this reserve pool as a transparent blockchain reserve asset class of $BTC and $ETH

- When we exchange $USTC for $BTC+$ETH, some other wallet would be buying an equivalent value of $USTC from us which remains in circulation and in the buying wallet

- Since it is assumed (in Point 1) that the buying wallet has bought $USTC to exchange for $INRT, during the time the $INRT is being issued to the buying wallet 0.1% fees will be deducted to burn (buy-back) an equivalent amount of $USTC and 0.1% additional fees will be charged to be sent to the Terra Luna Classic Community Pool for funding development work on the blockchain

- If the buying wallet instead stakes the $USTC with us (details in Specification Set 2), then the process flow will follow from Specification Set 2, otherwise, buying wallet will follow process flow from Specification Set 1 Point 5 again

Fig 1: Complete $USTC↔️$INRT↔️$USDTR Repeg System

Specification Set 2

- Rewards for staking $USTC with us will accumulate yield as $INRT, avoiding flooding supply of $USTC in circulation during rewards withdrawal

- Staking options for $USTC will be enabled with Auto-Compound (every 24 hours) and a lock-in period of 12-36 months (stakers will not be able to unstake before 12 months)

- While unstaking $USTC or claiming rewards as $INRT 0.1% fees will be deducted to burn (buy-back) an equivalent amount of $USTC and 0.1% additional fees will be charged to be sent to the Terra Luna Classic Oracle Pool for rewarding stakers on the blockchain

- No fees shall be deducted for the Auto-Compound function

The conditions or specifications described above have been translated into a block diagram (below) so that the process flow of the complete system can be visualized together.

Process

The complete repeg system described above can be subdivided (for sake of simplicity and understanding) into three separate parts of the system.

I have attempted to view and describe these parts individually and have provided details of each part under the following heads.

NOTE:

- Part 1 and Part 2 are separate processes

- Part 3 is a common process for both Part 1 and Part 2

Part 1 - The BUY Process

Fig 2: Part 1 - The BUY Process

Process Starts At: IN

Process:

-

Buying wallet provides liquidity to our $USTC Pool

-

Equivalent value of $INRT is calculated and issued to buying wallet

-

While buying $INRT,

-

0.1% $USTC is sent to Burn Module

-

0.1% $USTC is sent to the Terra Luna Classic Community Pool

-

$USTC from buying wallet is sent to Buy Module to exchange to $BTC+$ETH Reserves

Note - For sake of simplicity I have not shown the Burn Module here, which has been explained in Part 3.

Part 2 - The STAKE Process

Fig 3: Part 2 - The STAKE Process

Process Starts At: IN

Process:

-

Buying wallet stakes $USTC (provides liquidity) to our $USTC Pool

-

If $USTC is Unstaked coins move OUT of the system

-

While Unstaking,

-

0.1% $USTC is sent to Burn Module

-

0.1% $USTC is sent to the Terra Luna Classic Oracle Pool

-

If $USTC is Auto-compounded coins go back into $USTC Pool

Part 3 - The SWAP Process

NOTE:-

This is an INTERNAL swap “process” and has NOTHING to do with the Cosmos swap module (which is part of the bank module) that is currently defunct (market swap) on Terra Luna Classic.

THIS IS NOT A SWAP MODULE. THIS IS AN INTERNAL PROCESS TO DESCRIBE HOW $USTC IS CONVERTED TO $INRT AND APPLIES DURING BUYING AND UNSTAKING

Fig 4: Part 3 - The SWAP Process

Process Starts At: $USTC POOL

Process:

- Buying wallet sends $USTC to Burn Module

- Buying wallet requests to receive $INRT for $USTC

- $USTC is sent to Burn Module

- Remaining $USTC is sent to Exchange

- Reserves are created in $BTC+$ETH

- $INRT is issued to buying wallet

- Buying wallet sells or stakes

Modules

The plan has been divided into 2 sets of Specifications and 3 Parts of a parallel process system above which make up the high-level design of the system.

Now, we shall further divide the system into 6 different modules for a low-level explanation of the technical aspects of the system and to understand better what is required in order to code and execute such a system.

Module 1 - BURN Module ($USTC L2)

The Burn module is a misnomer for the function of this module, since a burn is simply a buy-back in the technical sense of the term, and a burn would entail to sending the coins to a zero address coded into the blockchain.

Such an address generally exists when a blockchain on Cosmos is instantiated with it’s genesis configuration file and should exist for $USTC as well.

Burns can be alternatively implemented by converting $USTC to a CW-20 token and then burning the token.

Module 2 - STAKE Module ($USTC L2)

The Stake module is simply a liquidity pool provider and handler. It does NOT cut the supply of $USTC directly since staked $USTC will be used to provide liquidity for the swap functionality in which buyers can make instantaneous swaps at market price between $USTC and $INRT.

We are already burning a substantial supply of the $USTC while unstaking and buying $INRT. This process does not require the development of a L1 staking module and can be handled completely on L2 functionality already present on the Terra Luna Classic blockchain.

Module 3 - BUY Module ($INRT L1/L2)

The Buy module connects to the $INRT Pool to issue $INRT tokens to the buying wallet. This module would already be present when the new $INRT blockchain is instantiated so there is no development required to build it specifically.

This buy module will enable $USTC to be sent to the $USTC Pool and track exactly how much is to be issued to the buying wallet. It will confirm the transaction when the equivalent value of $BTC+$ETH has been exchanged into the Reserve Pool, securing reserves 1:1 for the $INRT being issued to the buying wallet.

Module 4 - SWAP Module ($USTC L2)

As described before this, the Swap module is simply a common functionality to both the Buy and Stake modules, which is required for both modules to function properly.

This Swap module will enable $USTC swaps to $BTC+$ETH and track both issued and issuing wallets for confirmation of transactions on both the $USTC chain as well as the $INRT chain.

Module 5 - $USTC Pool ($USTC L2)

The $USTC Pool is one of the most important components of our system since it will be used to issue the initial set of tokens for $INRT which will be the first stablecoin correctly pegged to a currency after the Terra-Luna crash.

The initial investment required to create this pool has been described in the Budget section.

Module 6 - $INRT Pool ($INRT L1)

The $INRT resides on the $INRT blockchain and it is separated from the Terra Luna Classic community via a separate governance portal and discussion forum.

Tokens will be issued to holders in lieu of an equivalent amount of $BTC+$ETH which shall be held in reserves.

Thus, this $INRT pool of tokens issued during the creation of the blockchain will be inflationary in nature and new tokens will be issued/minted according to reserves we hold 1:1. This is similar to holding reserves in a bank in fiat, but in this case, we are holding it in a wallet in $BTC and $ETH.

Stability

$INRT is not an algorithmically controlled stablecoin. It is issued like any other cryptocurrency and traded at exactly ₹ 1 Indian Rupee.

$BTC (Bitcoin) and $ETH (Ethereum) will be held 1:1 as Reserves to issue new $INRT coins.

Minting is not permitted on the blockchain and the minting function will be deactivated for $INRT while it is being issued on the mainnet.

There is no method/function to issue new coins which will be made available to programmers to use via a SDK or API.

$INRT can be traded for only the following 23 currencies which exist on the Terra Luna Classic blockchain currently:

uaud, ucad, uchf, ucny, udkk, ueur, ugbp, uhkd, uidr, uinr, ujpy, ukrw, uluna, umnt, umyr, unok, uphp, usdr, usek, usgd, uthb, utwd, uusd

Please Note:- “u” before the name of the coin indicates “10 to the power of minus 6” = 10*-6* = 1÷1000000

Precautions

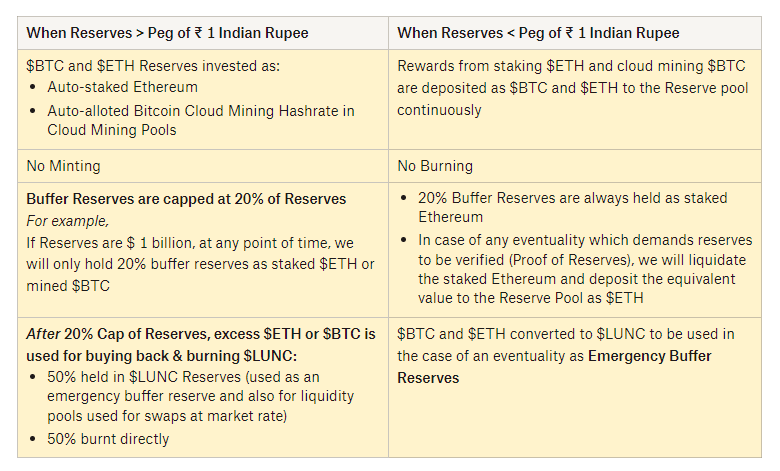

The following table describes the precautions the system takes in order to prevent a situation like a death spiral while providing enough buffer reserves (and emergency buffer reserves) to safeguard against any unforeseen market fluctuations or abnormalities:

Note:- The table above is the TL;DR version of this proposal/plan since it describes in brief how the peg to 1 Indian Rupee is kept at exactly 1 Indian Rupee, and how LUNC is burnt as a result of the functioning of this system/plan.

Community DEX

Although the following construct was not originally designed to be a DEX (since it is an extended explanation of how the system functions), it has now developed into what can be described as a decentralized exchange system, in which we can exchange, trade and swap between various currencies and forex traders may use the system as an arbitrage trading platform as well.

Fig 5: Complete Design/Architecture of the Community Dex

Wrapped Stable Tokens (WSTs)

While the concept of WSTs would probably demand a separate whitepaper on the subject, to understand the diagram above, it is essential that the reader understands the concept behind WSTs.

This is not a novel concept since wrapped tokens exist, like $wBTC and $wETH, which are pegged 1:1 to $BTC or $ETH respectively.

What we are introducing for the very first time to the Terra Luna Classic ecosystem (and potentially for the first time to the Cosmos ecosystem) is a concept of Wrapped Stable Tokens or WSTs which are pegged to the currencies that each represent.

For example,

1 $USTC is currently at a de-pegged value of ~ $ 0.02 USD

Or,

50 $USTC = 0.02 x 50 = $ 1 USD

We can issue a token which resides on the Terra Luna Classic blockchain that wraps 50 $USTC into 1 token which has the value of exactly $ 1 USD. We can call this issued token say, $USDTR.

As you may have observed from the diagram above, the WSTs have a naming convention and they all have a suffix of “TR” after the name of the currency. So, the name of the corresponding WST for $USD becomes $USDTR and $AUD becomes $AUDTR respectively.

$INRT acts as the stabilizer that pegs the value of 50 $USTC to 1 $USDTR and maintains it at exactly $ 1 USD even if the value of $USTC changes after the token has been issued.

The value of the token will remain $ 1 USD after that as well, since it is pegged to $INRT (as an intermediary) rather than being pegged to the value of $USTC after the token has been issued.

Uses of WSTs

- Can be used by forex traders for arbitrage trading directly since they are all pegged to their respective currencies

- Can be used as a store of value for governments, institutions and retail users who may choose to invest in the currency of their choice from currencies of 22 different countries

- Payments to merchants and vendors can be made in local currencies of 22 different countries which is extremely useful for the retail and commercial goods transport and trading industry

- Can be swapped/exchanged immediately for another WST since they are native to the Terra Luna Classic blockchain

- Can be used to swap/exchange between the de-pegged currencies or to swap/exchange WSTs for de-pegged currencies

Now that we have a clear understanding of what WSTs are and how we are using them as intermediaries, let’s explore the functionality of the decentralized exchange in brief.

Functionality

-

Swap/exchange any de-pegged stablecoin for it’s respective WST (explained above). For example, $AUD can be swapped for a Wrapped Stable Token (WST) called $AUDTR

-

Swap/exchange any de-pegged stablecoin to a different WST currency. For example, $AUD can be swapped for $CADTR

-

Trade between WST stablecoin pairs. For example, $AUDTR can be swapped for $CADTR and $INRTR can be swapped for $USDTR directly

-

Useful for arbitrage traders who might require capital infusion immediately using a different coin when they see profitable opportunities in the market

-

Extremely useful for frequent flyers to foreign destinations since WSTs can be exchanged/swapped for other stable denominations which represent the local currencies of 22 different countries

-

All de-pegged coins on the Terra Luna Classic blockchain can be traded for $INRT (a stablecoin) which acts as the stabilizer for the entire system pegging each de-pegged currency/denomination to it’s respective WST

-

Reverse swap/exchange WSTs for de-pegged stablecoins. For example, $AUDTR can be swapped for $INR

-

$INRT can be traded for only the following 23 currencies which exist on the Terra Luna Classic blockchain currently: uaud, ucad, uchf, ucny, udkk, ueur, ugbp, uhkd, uidr, uinr, ujpy, ukrw, uluna, umnt, umyr, unok, uphp, usdr, usek, usgd, uthb, utwd, uusd

-

Swap/trade/exchange $INRT on the Cosmos ecosystem. For example,

-

Buy Luna 2.0/Mars using $INRT

-

Swap $INJ for $INRT and stake on Injective/Kujira

-

Trade and cash out $INRT as $BTC or $ETH

-

$INRT is a gateway to Cosmos for de-pegged stablecoins like $USTC, $INT, etc.

Liquidity Pools

LP1 - Liquidity Pool of De-pegged Coins

This LP represents the current liquidity stuck on Terra Luna Classic which comprises of the de-pegged stablecoins apart from $LUNC. The exchange rate of the de-pegged coins are down by 50-100 times. Taking it out of the system without a repeg would mean losses of 50-100 times for any holder holding these coins and is thus not feasible. The TVL of this LP would decrease over time since the objective is to convert all de-pegged stablecoins to WSTs eventually.

LP2 - Liquidity Pool of $INRT

This is the primary LP of $INRT coins comprising of liquidity provided by users, buyers, investors, validators and other stakeholders of the system. The TVL of this pool changes in value continuously as it is pegged to the value of $BTC and $ETH as described earlier.

LP3 - Liquidity Pool of WSTs

This LP is controlled by traders issuing WSTs in exchange of de-pegged stablecoins on Terra Luna Classic. As more traders stake and issue WSTs, the TVL of this LP increases in value linearly over a period of time.

Advantages of a Community DEX

For Holders:

It provides a route to exit the liquidity loop in which most holders of the de-pegged stablecoins are stuck in; the money can’t be taken out of the system or utilized in any profitable way currently. $LUNC and $USTC are the only two supported currencies for trading in most cex’s and dex’s, out of 23 different currencies.

For Investors:

The community dex is an extremely lucrative platform for investors since they would be able to provide liquidity and get rewards, arbitrage/trade within the system (while having complete control over their money in a non-custodial wallet), stake any Terra Luna Classic currency and get rewarded in stablecoins which can be used directly on Cosmos, or even, for the more adventurous, invest in $LUNC Liquidity Staking Derivatives (LSDs) and cash-out as $BTC+$ETH (more about this in a separate whitepaper on the community dex).

For Validators:

$INRT is only allowed to be validated by Terra Luna Classic validators. This eligibility criterion will be mentioned in a separate whitepaper on $INRT, but it is important to mention this here since all gas fees used for transactions in this community dex will also go to validators of the Terra Luna Classic blockchain, whether it is for $LUNC, $USTC, WSTs or even $INRT (as mentioned earlier).

Pros & Cons

Disadvantages

- This is a complicated proposal so it will take time to build, issue, test and release a stablecoin pegged to an actual currency - almost 6 months

- Since I am a solo developer, I will take more time to develop this than I would have taken if I would have worked with an entire L1 Team of 6 people, but I do NOT wish to do so with the current iteration of the L1 development team nor am I willing to overcharge the community by making up non-existent developers

- I cannot possibly fund this proposal or work without money. It would have been possible had this been a small dapp or even a wallet. But I will need to provide FULL-TIME work to the community (6-8 hours each day - I have currently put approximately 8-10 hours each day to write this proposal) to complete this project within the stipulated 6 months period, and I cannot do this without a guarantee and appropriate remuneration of my employment with the Terra Luna Classic community

Advantages

- Places Terra Luna Classic on the map of DeFi projects once again by introducing a high-level technical architecture of a trading system in which all currencies on the Terra Luna Classic blockchain, including $LUNC, is being properly used as DeFi coins

- Burns supply of $LUNC, $USTC and other de-pegged Terra-Luna stablecoins directly by enabling trades/swaps/arbitrages between currencies

- Introduces a correctly pegged stablecoin to the ecosystem before $USDC becomes the default stablecoin of the Cosmos ecosystem/market

- Re-enables the market swap functionality without touching any L1 core module code (since it is not required to do so after the introduction of WSTs)

- Provides us with a Community DEX, transaction/gas fess of which will directly/indirectly go to the validators, delegators (Oracle Pool) and developers (Community Pool)

- Excess reserves from our Reserve Pool (after balancing the Buffer Reserve Pool) will be completely used to burn $LUNC

- Multiple macro and micro liquidity pools provide safety, security and much needed capital infusion to the Terra Luna Classic ecosystem

- Provides a way to enter and exit the Terra Luna Classic DeFi system without the need to use a centralized exchange for trading/swapping/staking: our system would enable traders to deposit in $BTC/$ETH and also withdraw as BTC/$ETH, making it extremely convenient for anyone to invest into the various currencies, WSTs and even a stablecoin on the Terra Luna Classic ecosystem

- Wrapped Stable Tokens are being introduced to the Terra Luna Classic ecosystem for the first time, probably, on any blockchain, which re-enables arbitrage trading between currencies

- I AM the developer who is going to develop this entire system with minimal external help. I am directly reachable 24x7 via Agora, Discord, Telegram, Email and if required, on WhatsApp

- I DO NOT require the help of the L1 Team to do my work and execute this plan end-to-end. I also do not require the help of other developers since I am a Senior Full Stack developer myself

- I will provide DAILY updates with complete details about work done. If I take a holiday I shall inform the community beforehand about leaves well in advance

… To be Continued in the next comment