Summary

UST has lost peg to $1 for multiple days starting from May 8th, 2022.

UST peg has not recovered from more than a couple days now.

There are a large amount of UST withdrawal, but burning of UST is slow.

Proposal is to:

- Increase BasePool from 50M to 100M SDR

- Decrease PoolRecoveryBlock from 36 to 18 Blocks

This will increase minting capacity from $293M to ~$1200M

Motivation

Starting from May 9th to May 10th 2022, about $8B UST were withdrawn from Anchor Protocol ($14B.- $6B = $8B)

During the same period, only ~$1B UST were burned

With slow recovery of UST price, the market is losing confidence of UST peg, where traders and speculators keep pushing both UST de-peg, and push down LUNA price in an aggressive way.

Traders and speculators are taking advantage of the information that UST peg restoration will burn billions more UST and mint billions more LUNA.

Traders are front running and selling/shorting more LUNA and pushing LUNA price down. When the UST Mint/Burn peg trades eventually happens, these Mint/Burn will happen at a worse price, resulting more-than-necessary LUNA being minted.

To address this front running, and to protect Terra/Luna Ecosystem, here is to propose increase of BasePool size and decrease of recovery block, to increase total daily minting capacity 4x.

Proposal

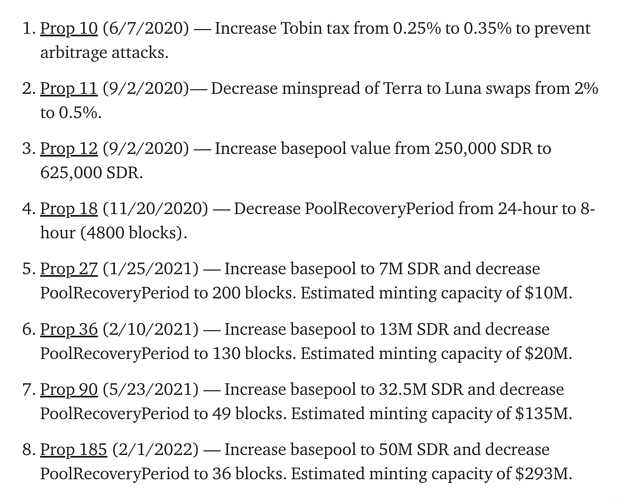

Terra protocol has gone through a number of changes on BasePool size and PoolRecoveryPeriod

Current parameters are here:

https://lcd.terra.dev/market/parameters

In the recent months, UST circulation supply has increase to a peak of $18.7B on May 7th, 2022.

A market shock on May 8th, 2022, with broad based sell off across all cryptos, has pushed LUNA market cap to drop below UST market cap.

This has further triggered huge withdraw of UST from Anchor Protocol. More than $8B UST has been withdrawn from Anchor in less than 2 days.

While investors withdraw UST quickly, the UST burning speed is much slower. About $1B UST were burned during the above period when more than $8B were withdrawn.

The slow burning speed creates an extended period of UST de-peg.

LFG Effort

It is applauded that Luna Foundation Guard (LFG) is making an effort to engage with trading firms to bring back the peg, and is working towards buying more BTC. Nevertheless, the market have its own way of working.

If LFG go with more leverage, the speculators would only try to push the boundaries and push the liquidation of the known counter party.

The UST and LUNA has its own pegging mechanism, using Mint and Burn. However, the majority of the current market movements (de-peg of UST and price drop of LUNA) are not from this Mint and Burn, but from speculative trading activities.

Even LFG has $3.5B bitcoin in capital (current value probably much less), running against the market will be dangerous for Terra.

In extreme situation like this, Terra cannot save both UST peg, and save LUNA price at the same time.

LFG’s limited capital is risky, compared to speculative traders from everywhere.

Remember 2008? when each and every Investment Bank were attacked, one by one, until they were bankrupt, or got acquired, or got huge external funding.

Speculators does not stop, until they know there are no weakness to exploit.

Allow more efficient UST burning and LUNA minting, will in the short term put pressure to LUNA price, but will be an effective way to bring UST back to peg, which will eventually stabilize LUNA price.

Yes, billion of UST will be burned, and LUNA will be diluted significantly. Nevertheless, there are no limit in LUNA supply, this market mechanism will actually work to bring stable UST and stable LUNA price (although likely at lower price point for LUNA).

If efficient Burn/Mint is not available for an extended period, this can leave UST to be out of peg for a long period, which will significantly undermine the confidence in the market, and continue to encourage speculators to push down the peg and can potentially crash entire Terra Ecosystem.

Front Running

When burning is slow, the traders know that billions more LUNA will be minted due to UST withdrawal.

The slow burning process incentivizes traders and speculators to front run a predicable and well-known phenomena, e.g. billions more UST will be burned, and billions LUNA will be minted.

Knowing billions LUNA to be minted, traders and speculators can push down LUNA price ahead of time before the market warrants so, and force UST Mint/Burn pegging mechanism to pay a worse price.

During this extended period of time when UST losses peg, more-than-necessary amount of LUNA will be minted to restore UST peg.

A speedy recovery of UST pegging will be beneficial to the Terra / LUNA community.

Please kindly consider, or suggest other perspectives.

Thank you.

Notes

The reason that $1B UST burning is higher than $293M capacity can be due to following:

- When UST is de-peged, the arbitrage capacity is higher than when UST is near peg

- Traders / arbitragers are competing for the arbitrage opportunity, and commit more capital than market equilibrium

References